That favorite time of year has come around once again. Time to file your tax returns! And to help ensure you are prepared to complete and file your returns, we wanted to remind you of a few forms to be looking for if you are one of our clients who used a 1031 exchange to sell investment property last year.

Important Real Estate-Related Forms

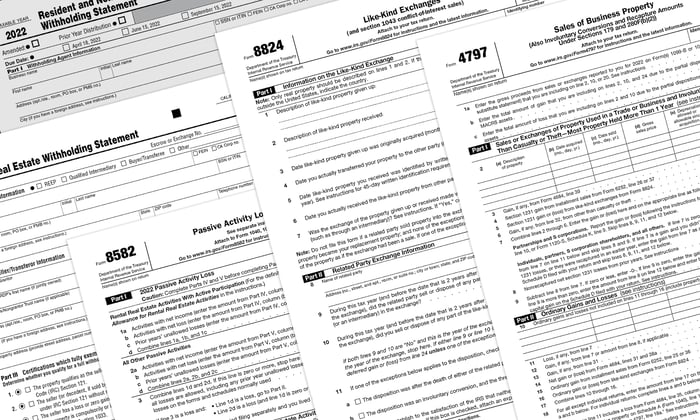

For purposes of this article, we will only highlight the Federal IRS forms related to 1031 exchange real estate transactions.

Form 8824

You will need to complete IRS Form 8824 and file it with your tax return if you have completed a 1031 exchange. You will report your exchange for the tax year that you closed and settled on your relinquished property, and the 180-day exchange period began.

Form 8582

You may need to complete IRS Form 8582 if you have carry-forward passive activity losses you would like to apply against gains from a passive income-generating investment you own, such as a Delaware Statutory Trust.

Form 4797

You will use IRS Form 4797 or Schedule D to report any recognized taxable gain on the sale of your relinquished property in a 1031 exchange transaction. The taxable gain must be allocated between ordinary income, depreciation recapture, unrecaptured Section 1250 taxable gain, Section 1232 taxable gain, and capital gain.

Also, depending on the state where your relinquished property was located, you may need to file an exemption form if the state requires mandatory withholding on the sale of investment property.

Conclusion

Reporting on 1031 exchange investment properties requires the use of several federal tax forms. After meeting the necessary definition requirements, 1031 exchange taxpayers must file Form 1040 as well as Form 8824, Form 4797 (or Schedule D), and Form 8582 when necessary.

Overall, it is important for investors to understand the tax forms and regulations involved in a 1031 exchange in order to properly report on their investment. As always, we recommend you work with a qualified tax professional when preparing your income tax return.

Want to learn more about tax deferral through a 1031 exchange? Download our free e-book today!

Because investor situations and objectives vary this information is not intended to indicate suitability or a recommendation for any individual investors.

This is for informational purposes only, does not constitute individual investment advice, and should not be relied upon as tax or legal advice. Please consult the appropriate professional regarding your individual circumstance.

There are material risks associated with investing in real estate securities including liquidity, tenant vacancies, general market conditions and competition, lack of operating history, interest rate risks, the risk of new supply coming to market and softening rental rates, general risks of owning/operating commercial and multifamily properties, short term leases associated with multi-family properties, financing risks, potential adverse tax consequences, general economic risks, development risks, long hold periods, and potential loss of the entire investment principal.

Investment advisory services offered through Bangerter Financial Services, Inc. A state Registered Investment Advisor. Registered Representative and securities offered through Concorde Investment Services, Inc. (CIS), member FINRA/SIPC. Bangerter Financial Services, Inc. is independent of CIS.

.png?width=273&height=103&name=Brokercheck%20(1).png)

Comments