In 1859, Edwin Drake drilled what many believe was the first oil well in the U.S. near Titusville, Pennsylvania. Drake could not have imagined how his discovery would create an industry that changed the world. Investment in oil and gas exploration increased over the next forty years, with activity expanding beyond the Appalachian Mountains into other areas of the country. Early drillers sought oil to refine into kerosene for lamps, a new lighting technology at the time.

The Dawn of the Petroleum Age

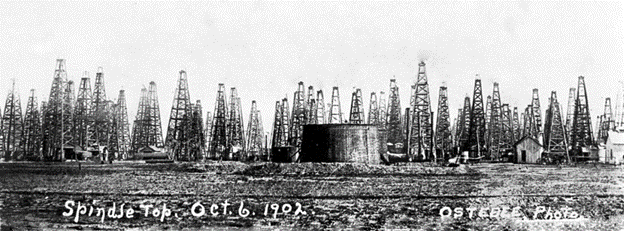

On January 10, 1901, Anthony Lucas, an expert in underground salt dome formations, along with his wildcat drilling partners, reached a depth of 1,139 feet with an exploratory well on Spindletop Hill near Beaumont, Texas. Within moments, as the ground rumbled, the drill pipe blew out of the hole, and a stream of oil 100 ft high gushed 100,000 barrels a day for nine days before the well was brought under control.

What quickly became known as the "Lucas Gusher," the Spindletop well was of a magnitude the world had never seen. The excitement of the discovery combined with Henry Ford's introduction of the gasoline-powered automobile simultaneously spurred an unparalleled level of investment and growth. The modern petroleum age was born.

Source: https://www.lamar.edu/spindletop-gladys-city/spindletop-history.html

Source: https://www.lamar.edu/spindletop-gladys-city/spindletop-history.html

The Seven Sisters and the Emergence of Independents

By the 1930s, five domestic and two international conglomerates, the “Seven Sisters,” dominated the world oil industry. Though their names changed through mergers and acquisitions over the years, they reigned supreme through the 1970s. (Four behemoths remain today: BP, Shell, Chevron, and Exxonmobil.) When the “Seven Sisters” dominated the industry, individual investing was limited largely to the publicly traded stocks of the early conglomerates.

The financial strength of the major oil companies enabled them to focus on exploring larger oil and gas fields in the Gulf of Mexico, Alaska, and throughout the world. This gave room for smaller, independent oil and gas companies to pursue onshore domestic drilling programs, which created the opportunity for individuals to begin investing directly in oil and gas drilling programs.

An Embargo, Industry Collapse and the LP Investment Wave

The '70s and early '80s were not kind to the U.S. oil and gas industry. America endured OPEC's oil embargo in 1973 as Arabs retaliated against the Nixon administration for funding Israel during the Arab-Israeli War. Oil prices soared, and consumers felt the pain.

Higher prices stimulated increased exploration activity by majors and independents, but by the early '80s, this reversed course. A global glut sent oil prices plunging. Hundreds of companies collapsed, and tens of thousands of industry workers lost their jobs.

Ironically, the emerging popularity of the limited partnership (LP) in 1983 fueled a new wave of industry investment. Brokerage firms marketed these programs aggressively to clients as an opportunity to achieve outsized returns along with tax advantages. Money poured in.

True to the industry's 'boom or bust' reputation, the LP investment wave didn't last long. The Tax Reform Act 0f 1986 removed many of the tax shelter and passive loss provisions of these investments, and LPs began to disappear from investors' playbooks.

Horizontal Drilling, Fracking, and the Shale Boom

Horizontal Drilling, Fracking, and the Shale Boom

New exploration technologies transformed the oil and gas industry in the '90s. Innovative horizontal drilling techniques enabled the industry to efficiently drill several wells from a single pad. Exploration companies were also able to tap into oil and gas reservoirs at an angle, providing greater access to the pay zone.

Combining the long-established process of hydraulic fracturing with horizontal drilling led to a new age, the “Shale Boom.” Exploration

companies discovered around 2006 that these technologies could transform the profitability of once uneconomic, tight oil and gas formations. Domestic exploration exploded, culminating with the U.S. emerging as the world's leading oil producer by 2017.

Oil and Gas Investment Options Today

With the industry's growth, investors now have multiple ways to participate in the oil and gas industry. Publicly traded instruments available to investors include:

- Energy stocks

- Exchange-traded funds (ETFs)

- Mutual funds

- Master limited partnerships (MLP)

- American Depository Receipts (ADRs)

- Futures and options

- Direct Participation Programs

Each investment option has its advantages and potential drawbacks, so it's important to discuss these opportunities with a knowledgeable investment professional who has years of experience working with DPP sponsors.

If you would like to learn more about oil and gas investment opportunities, download our free guide, Investing in Oil and Gas, What You Need to Know or give us a call at 916.965.1879.

1 Potential cash flows/returns/appreciation are not guaranteed and could be lower than anticipated.

Because investor situations and objectives vary, this information is not intended to indicate suitability or a recommendation for any individual investor.

This is for informational purposes only, does not constitute individual investment advice, and should not be relied upon as tax or legal advice. Please consult the appropriate professional regarding your individual circumstance.

Investments in commodities may have greater volatility than investments in traditional securities, particularly if the instruments involve leverage. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. Use of leveraged commodity-linked derivatives creates an opportunity for increased return but, at the same time, creates the possibility for greater loss.

Mutual Funds and Exchange Traded Funds (ETF’s) are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from the Fund Company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

A direct participation program (DPP) is a pooled entity that offers investors access to a business venture's cash flow and tax benefits. Also known as a "direct participation plan," DPPs are non-traded pooled investments in real estate or energy-related ventures over an extended time frame.

Investment advisory services offered through Bangerter Financial Services, Inc. A state Registered Investment Advisor. Registered Representative and securities offered through Concorde Investment Services, Inc. (CIS), member FINRA/SIPC. Bangerter Financial Services, Inc. is independent of CIS.

.png?width=273&height=103&name=Brokercheck%20(1).png)

Comments